WHAT DOES NOVA AGRITECH LTD DO?

Nova Agritech Limited is an agri-input manufacturer focusing on soil health management, crop nutrition, and crop protection products. Their approach is tech-based and farmer-driven, offering ecologically sustainable and nutritionally balanced products developed through research and development. They have diverse product categories, including soil health management, crop nutrition, biostimulants, biopesticides, integrated pest management, new technologies, and crop protection.

As of November 30, 2023, the company has received 720 product registrations across different categories. They operate through a substantial dealer network of approximately 11,722 dealers, with a presence in 16 states of India and 2 in Nepal. Additionally, they have entered into agreements in Bangladesh, Sri Lanka, and Vietnam, pending necessary permissions.

The company generates a significant portion of its revenue from product distribution in the southern states of Andhra Pradesh, Karnataka, and Telangana. Their manufacturing facilities, including warehousing, are located in Telangana.

WHAT IS THE ISSUE SIZE OF NOVA AGRITECH LIMITED IPO?

The entire public offer of the company is a fresh issue of Equity Shares aggregating up to ₹ 112 Crores and an offer for sale (OFS) of up to 0.78 crore Equity Shares from the existing shareholders.

RISK FACTORS TO CONSIDER:

Government policy changes or a decrease in subsidies and incentives, for the agriculture sector may have negative impacts on the business and financial performance.

The company’s logo is currently facing opposition. A third party has filed an objection against the trademark registration and if the company fails to defend against the opposition, the trademark may be canceled, leading to a loss of usage rights.

The company, along with its subsidiaries, promoters, and directors, is currently engaged in legal proceedings and potential litigation. Unfavorable outcomes in these cases could result in liabilities or penalties, posing a risk to the company’s business and impacting its financial results.

The business is susceptible to the impact of weather conditions, with seasonal fluctuations and unfavorable weather patterns potentially causing adverse effects on its overall performance, operational results, and financial health.

GREY MARKET PREMIUM (GMP)

The Grey Market Premium of Nova AgriTech Limited is around 48.60% as of 23/01/24.

Please Click here for the latest GMP prices and Updates

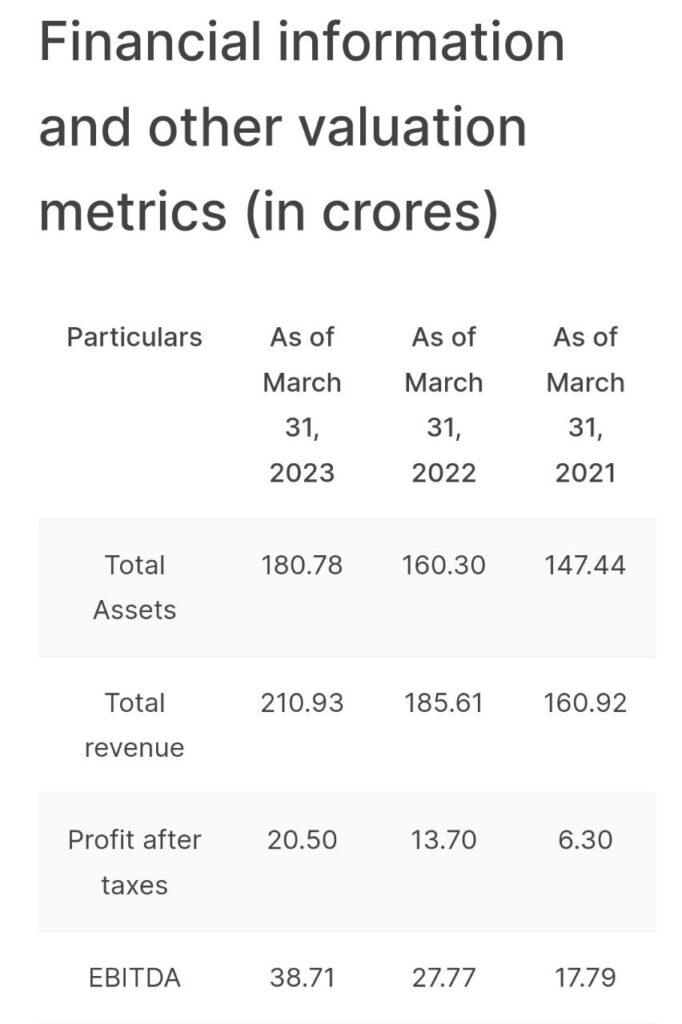

FINANCIALS: